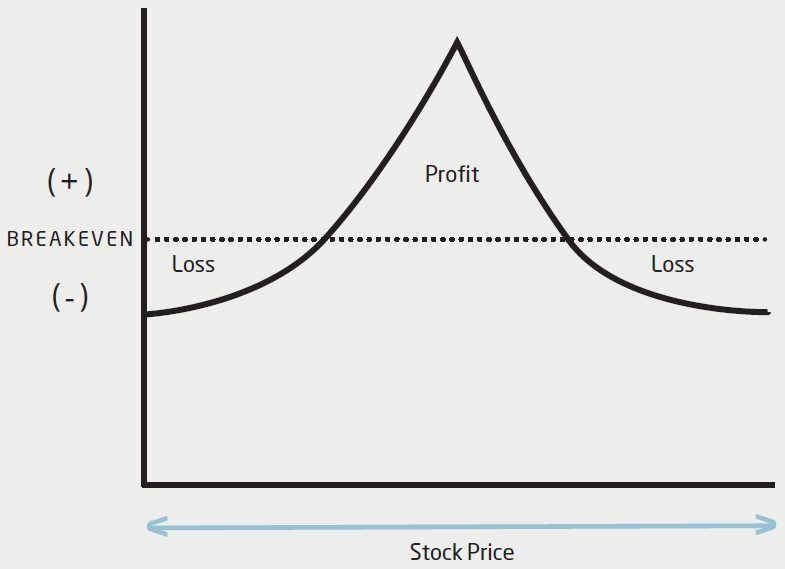

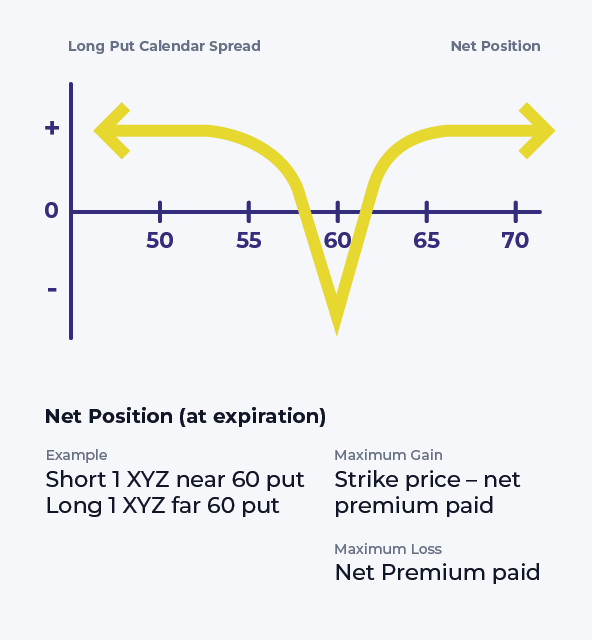

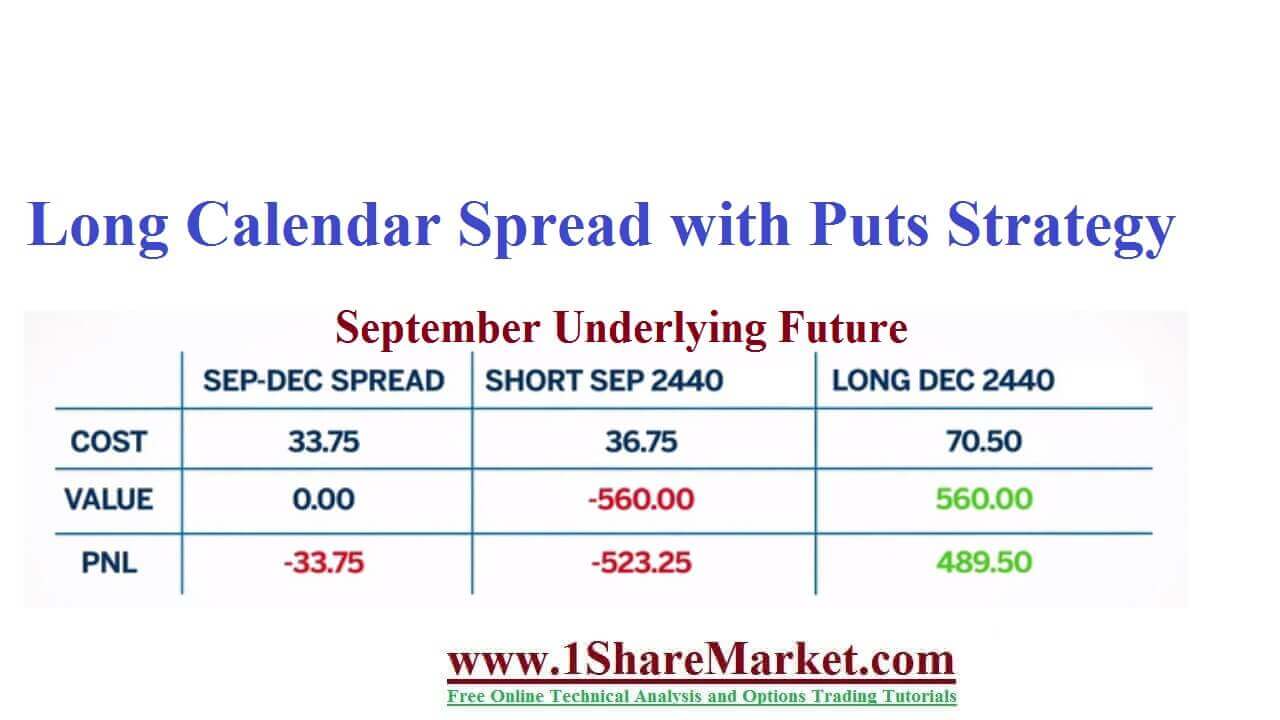

long calendar spread with puts. A trader may use a long put calendar spread when they expect the stock price to stay steady or rise slightly in the near term. The long put calendar spread is also known as a “long time spread” or “long horizontal spread.” “long” signifies the strategy involves a net debit or cost.

long calendar spread with puts The long calendar spread with puts is also known by two other names, a “long time spread” and a “long horizontal spread.” “long” in the strategy name implies that the strategy is established for. Long put calendar spreads will require paying a debit at entry. A trader may use a long put calendar spread when they expect the stock price to stay steady or rise slightly in the near term.